By 2026, the competitive landscape of mining pools has fully extended to the upstream of the industry. Top mining pools are no longer satisfied with simply aggregating computing power, but are deeply integrating firmware layers, mining machine management platforms, dynamic energy optimization systems, and derivative financial instruments, transforming computing power into a highly liquid digital asset that can respond in real-time to fluctuations in the electricity market and futures price signals. Today's top mining pools have long surpassed the role of passively receiving computing power, evolving into intelligent decision-making centers that drive and optimize global mining activities.

This article provides an in-depth analysis of the core competitiveness of mainstream mining pools to help you accurately choose the mining pool that suits you.

Which Bitcoin mining pool is the best?

1. When choosing a Bitcoin mining pool, you should consider at least three key factors: fees, minimum payout amount, and pool size.

1) Fees refer to the percentage deducted from your earnings. Most mining pools charge fees, but the fees vary. While lower fees are attractive, this is not the most important factor when choosing a mining pool. Some mining pools with higher fees may invest in better infrastructure, wider distributed regional servers, more efficient block propagation networks, or more advanced miner tools, all of which can effectively increase your actual earnings by reducing invalid shares and downtime. In addition, you should also pay attention to whether the mining pool shares transaction fees with miners: typically, FPPS and PPS+ pools include this, while some PPLNS pools may not. Therefore, the key to measuring the value of a mining pool is not the single fee rate, but the net income per unit of computing power (such as per TB).

2) The minimum payout amount is the minimum mining revenue threshold you need to reach before the mining pool pays you your earnings. For example, if a mining pool has a minimum payout threshold of 0.005 BTC, and your daily earnings are only 0.002 BTC, you will need to accumulate earnings until you reach 0.005 BTC before a payout is triggered. A higher minimum payout threshold may lead to longer payout cycles for miners with lower computing power, increasing the time funds are held in the mining pool and consequently increasing counterparty risk. Conversely, a lower minimum payout threshold or support for customizable payout thresholds, while allowing for faster access to earnings, may come with higher transaction fees per withdrawal. Therefore, when choosing a mining pool, it is recommended to evaluate your computing power level in conjunction with the mining pool's payout threshold to determine the frequency and cost of receiving payments, thus making a choice that best suits your needs.

3) The size of the mining pool directly affects the stability of revenue distribution. Large mining pools with a higher proportion of computing power, due to their higher block discovery frequency, can provide a smoother and less volatile revenue stream, suitable for miners seeking stable and predictable income. Smaller mining pools, while having longer block cycles and more noticeable revenue fluctuations, usually have lower fees and contribute to the decentralization of computing power distribution, aligning with some miners' values regarding network decentralization. Therefore, some miners choose to allocate their computing power to mining pools of different sizes, balancing revenue stability while supporting network diversity and resilience.

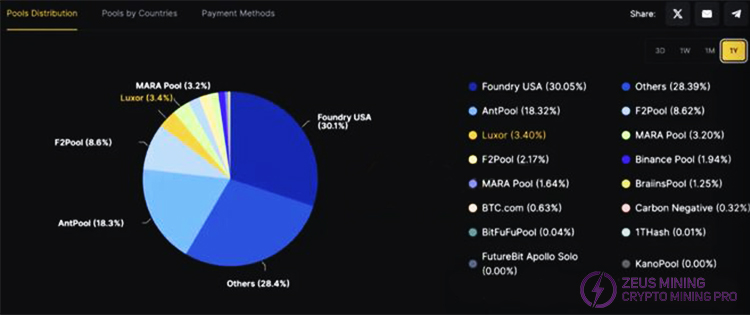

2. The following are Bitcoin mining pools ranked by estimated computing power share in 2026:

| Rank | Pool | Hash Rate(EH/s) | Hash Rate Percentage |

| 1 | Foundry USA | 299 | 30.1% |

| 2 | AntPool | 211 | 18.3% |

| 3 | ViaBTC | 145 | 13.0% |

| 4 | F2Pool | 113 | 10.0% |

| 5 | SpiderPool | 98 | 8.8% |

| 6 | MARA Pool | 64 | 5.7% |

| 7 | SecPool | 55 | 4.9% |

| 8 | Luxor | 38 | 3.4% |

| 9 | Binance Pool | 26 | 2.3% |

| 10 | SBI Crypto | 15 | 1.3% |

3. The following is an analysis of the major Bitcoin mining pools ranked by estimated hash rate share in 2026:

1) Foundry USA

As a US-based mining pool supported by Digital Currency Group, Foundry USA continues to maintain its leading position in global hash rate thanks to its deep collaboration with institutional miners, compliance-first operating strategy, and close ties with North American mining and hosting service providers. It uses the FPPS (Full Pay Per Share) payment method, providing predictable returns.

2) AntPool

Leveraging Bitmain's global supply chain and brand advantages, AntPool remains the preferred mining pool for many miners, especially Bitmain partners. This mining pool uses the FPPS (Full Pay Per Share) payment method, providing predictable and stable returns.

3) ViaBTC

ViaBTC, a global mining pool with a long operating history, has a significant advantage in Russia and surrounding regions. ViaBTC was one of the first mining pools to adopt the PPS payment method, providing stable basic rewards and transaction fee sharing. Its hash rate consistently ranks among the top three Bitcoin mining pools.

4) F2Pool

As one of the earliest established mining pools, F2Pool has maintained its industry influence through continuous technological iterations and early promotion of joint mining. F2Pool primarily uses its signature PPS+ payment model. At the same time, to meet the needs of different miners, it also generally supports the industry-standard FPPS model.

5) SpiderPool

SpiderPool has rapidly risen to prominence with its highly stable infrastructure and competitive FPPS settlement scheme. Designed specifically for institutional users and operating US-centric infrastructure, it is an ideal choice for professional and large-scale miners seeking stability and compliance services.

6) MARA Pool

MARA Pool is an attempt by the listed mining company Marathon Digital to vertically integrate into the mining pool business. MARA Pool uses the FPPS payment method to provide the highest degree of return stability and predictability.

7) SecPool

SecPool continues to expand in the Asian market, attracting hash rate with stable FPPS settlement and reliable infrastructure services.

8) Luxor

As the first US-based mining pool, Luxor has achieved a high degree of integration in the mining industry chain. Its pioneering prepaid fixed-income model allows miners to lock in revenue in advance.

9) Binance Pool

Binance Pool is an extension of the exchange's foray into the mining sector. Its importance stems primarily from its deep integration with Binance's trading, custody, and financial ecosystem, rather than from breakthroughs in mining technology itself. It supports multiple payment models (FPPS, PPS+, PPS, PPLNS) and provides predictable returns.

10) SBI Crypto

Part of the Japanese SBI Group, this mining pool caters to global miners, emphasizing operational reliability and institutional-grade collaboration. Although its hash rate share is limited, it still holds strategic significance in the Asian market.

Analysis of Different Bitcoin Mining Pool Payment Methods

1. PPS (Pay Per Share)

The mining pool pays a fixed reward for every valid share you submit. Regardless of whether the mining pool successfully mines a block, you receive this stable income, with the risk primarily borne by the mining pool.

2. FPPS (Full Pay Per Share)

Based on the fixed block reward paid by PPS, FPPS also calculates and pays the transaction fees included in each block. The revenue is more complete and still maintains a high degree of stability.

3. PPS+ (Enhanced Pay-Per-Share)

This uses a hybrid payment model: the block reward portion is distributed at a fixed rate using the PPS method, ensuring stable basic income; the transaction fee portion is distributed variably using the PPLNS method, allowing you to share in the high transaction fee revenue during network congestion.

4. PPLNS (Pay-Per-Last-N-Shares)

Earnings are entirely tied to the actual blocks mined by the mining pool. Only when the mining pool successfully mines a block will the earnings be distributed based on your contribution proportion within the last N shares of that block. In this mode, maintaining a stable connection is crucial, as disconnections will cause your contribution shares to be removed from the settlement window, thus reducing or eliminating your earnings for that block.

How to choose the right mining pool for you?

Your role | Prioritized features | Suitable mining pool types |

Beginner/Low-power miners | Stable payments, low entry barrier, ease of use, and predictable returns | Large or medium-sized FPPS mining pools, with low payment thresholds |

Professional miner | High real net profit, stable server performance, and comprehensive APIs and tools | Considering factors such as overall evaluation, rates, settlement model, and latency, PPLNS can be considered |

Miners who prioritize decentralization | The computing power is not overly concentrated, and the community has a good reputation | Medium-sized, non-leading mining pools |

Miners who strive for innovative services | Value-added services (such as computing power financing and energy optimization) | Specialized mining pools offering full-stack services (such as Luxor) |

Mining pools are no longer merely passive distributors of profits; they are gradually evolving into liquidity providers, risk managers, and coordination layers, situated at the intersection of hardware, software, energy, and finance.

Disclaimer:

For cryrrenptocucy tutorial purposes only, not investment advice. This website is not responsible for the actions taken by readers based on the information in this article.

For more product and service information, please click to join our official Telegram channel