U.S. asset manager Bitwise has forecast a wave of new crypto-linked exchange-traded funds (ETFs), predicting that more than 100 such products could launch in the United States by 2026 as regulatory clarity accelerates and issuer barriers fall.

In a post shared on X, Bitwise said recent regulatory developments have set the stage for what it described as an “ETF-palooza,” marking a sharp shift from years of regulatory resistance toward broader institutional access to digital assets.

Regulatory Shift Opens the Floodgates

According to Bitwise, a key inflection point came in October 2025, when the U.S. Securities and Exchange Commission published generic listing standards for crypto-linked ETFs.

The move allows issuers to bring products to market under a standardized framework, rather than seeking bespoke approvals for each fund.

This change is expected to shorten approval timelines and reduce legal uncertainty, making it easier for asset managers to launch ETFs tied to a wide range of digital assets and crypto-related strategies.

“A clearer regulatory roadmap in 2026 is why we see the stage being set,” Bitwise said, pointing to the cumulative effect of rulemaking, court rulings, and precedent-setting approvals over the past several years.

From Bitcoin to Broad Crypto Exposure

The prediction builds on a rapid evolution in the U.S. crypto ETF market. After more than a decade of rejected applications, spot Bitcoin ETFs finally launched in early 2024.

In 2025, the scope widened again with the launch of Solana-linked ETFs, alongside new generic listing standards that reduced regulatory friction. Bitwise’s timeline also points to potential XRP and Dogecoin ETFs entering the market before 2026, reflecting growing issuer confidence in demand for diversified crypto exposure.

If realized, the expansion would move the ETF market beyond single-asset products toward thematic, basket-based, yield-oriented, and strategy-driven offerings.

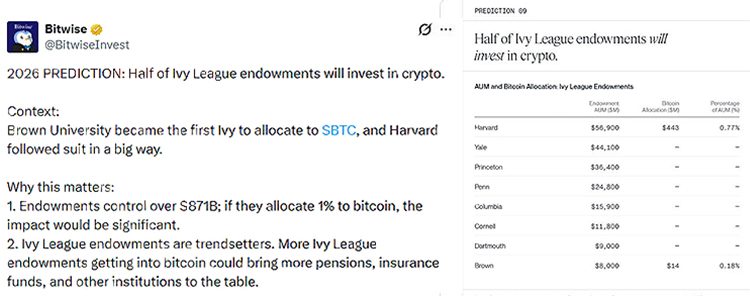

Institutional Demand Drives Momentum

Market participants say institutional appetite is a key driver behind the surge. ETFs offer regulated, familiar access to digital assets for pension funds, wealth managers, and retail investors who may be restricted from holding tokens directly.

By embedding crypto exposure within traditional market infrastructure, ETFs also reduce operational hurdles around custody, compliance, and risk management — long-standing concerns for institutional allocators.

Bitwise’s forecast suggests competition among issuers could intensify as firms race to capture first-mover advantage in niche segments, potentially driving fee compression and product innovation.

Bitwise Chief: Bitcoin to Hit Fresh Records in 2026

Bitwise Chief Investment Officer Matt Hougan and Grayscale Research both project BTC will exceed its previous peak despite conventional wisdom suggesting 2026 should be a pullback year. Forecasting that Bitcoin will shatter its traditional four-year cycle and reach new all-time highs in 2026, driven by massive institutional capital inflows and regulatory clarity.

Bitcoin has historically followed a four-year cycle tied to halving events, with three significant up years followed by sharp corrections.

For more news and information, please click to join our official Telegram channel.