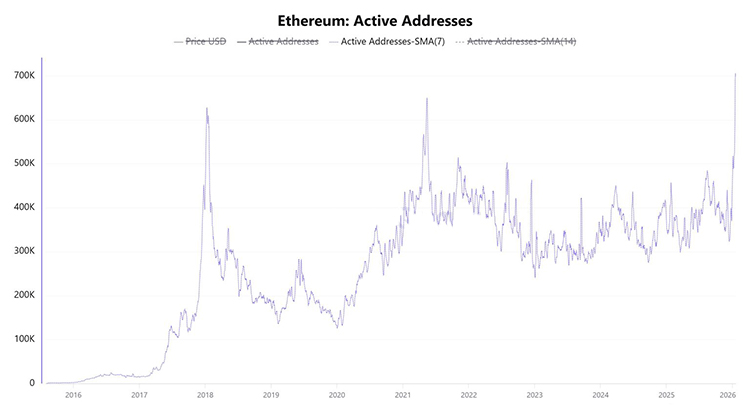

On-chain activity for Ethereum has reached an all-time high, but Ethereum price predictions have yet to catch up, indicating underlying momentum.

The weekly active addresses just hit a historic high of 706,000, surpassing the peak of the last bull market, signaling widespread adoption across the network.

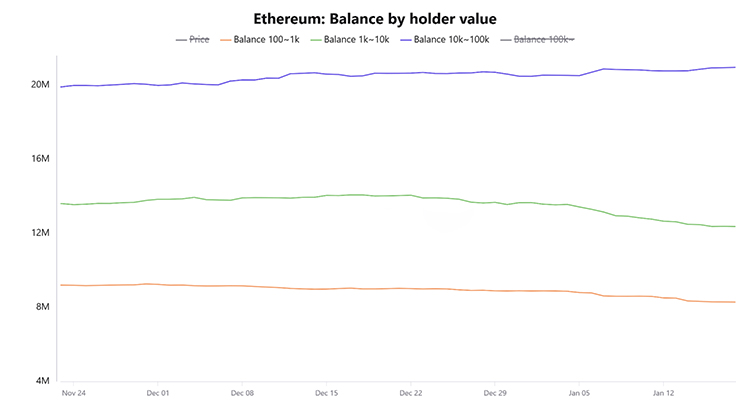

Despite strong on-chain transactions, market participants remain selective. Only the whale cohort continues to accumulate, with wallets holding 10,000 to 100,000 ETH adding approximately 190,000 ETH over the past week.

Retail behavior tells a different story. Wallets holding 1,000 to 10,000 ETH and 100 to 1,000 ETH have been reducing their holdings, likely in response to macroeconomic uncertainty and geopolitical tensions between the U.S. and NATO regarding Greenland.

While indicators point to a disconnect between fundamentals and market behavior, technical analysis suggests that bullish momentum for this altcoin is quietly building.

Ethereum Price Prediction: Key Levels Could Trigger a Surge

Since Ethereum hit a local bottom in November, a series of higher lows has established a decisive support trendline, compressing the price near the upper resistance level.

This has formed a symmetrical triangle spanning two months, now approaching its apex—meaning the next retest of support could be prolonged, followed by either a breakout or breakdown.

Momentum indicators remain bullish. Although the Relative Strength Index (RSI) has fallen below the neutral level of 50, its uptrend line suggests a rebound could be imminent.

The recent MACD death cross may also be temporary, reflecting a market consolidation phase rather than a broader trend reversal.

The key breakout threshold lies near a divergence zone around $3,350. If this level transforms into support, it could pave the way for a push toward all-time highs, with a breakout target of $4,800, representing a 55% upside.

Traders should remain cautious around the $4,250 level, which serves as strong interim resistance for this rally.

For more news and information, please click to join our official Telegram channel.