Bitcoin (BTC) is currently attempting to stabilize at $76,273, despite a 3% drop in the past 24 hours, indicating significantly increased market volatility. Even with the recent pullback, spot Bitcoin ETFs still recorded $562 million in inflows, showing that large institutional investors are buying the dip and remaining active.

Daily trading volume has reached $67.8 billion, and a battle is unfolding between short sellers and companies looking to increase their holdings.

London Stock Exchange's New Star: SWC Becomes the UK's Largest Bitcoin Holder

This week, Smarter Web Company (SWC) officially listed on the London Stock Exchange's main market, marking a significant moment for the UK financial sector. The company currently holds 2,674 Bitcoins, making it the largest publicly listed Bitcoin holder in the UK and ranking 29th among global listed companies.

CEO Andrew Webley has set a target for the company to join the FTSE 250 index by 2026, signifying a major step forward in the adoption of Bitcoin by British businesses.

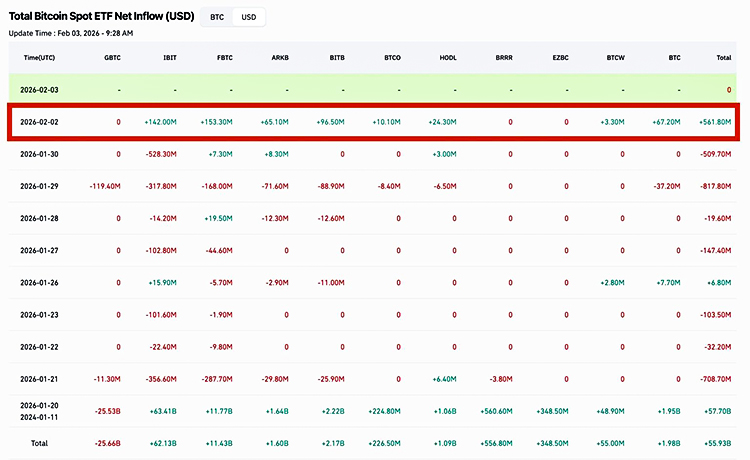

ETF Powerhouse: Buying the Dip with $562 Million

After four consecutive days of outflows, spot Bitcoin ETFs made a strong comeback this Monday, attracting $562 million in new funds. This indicates that some investors are "buying the dip" as Bitcoin recovers from its weekend weakness, partially offsetting the massive $1.5 billion sell-off last week.

Bitcoin Technical Analysis: Bulls Hold the $74,000 "Defense Line"

After the price fell to a nine-month low of $74,500 due to a "liquidity flush," Bitcoin is currently in a consolidation phase. Before the pullback, BTC had been oscillating within a large symmetrical triangle. While the break below $80,000 weakened the short-term bullish sentiment, the long-term target remains the psychological $100,000 mark.

The daily RSI has entered the 28-30 range, which usually means the market is oversold and a reversal may be imminent. A golden cross has appeared on the stochastic indicator, further suggesting that selling pressure is easing. Currently, structural support is located in the $74,420–$74,666 range, and the price needs to reclaim $78,400 (the 0.236 Fibonacci retracement level) to challenge resistance above $84,000 again.

Conclusion

Current market conditions indicate that overleveraged positions are being healthily cleared. With Smarter Web leading corporate Bitcoin adoption on the London Stock Exchange and ETF funds resuming inflows, the core bullish logic remains solid. If buyers can maintain Bitcoin above $74,000, then reaching the $100,000 target may be more likely than it seems.

For more news and information, please click to join our official Telegram channel.