Despite Bitcoin and Ethereum prices falling by 2.18% and nearly 4% respectively in the past 24 hours, BlackRock, a cryptocurrency ETF issuer, continues to increase its holdings.

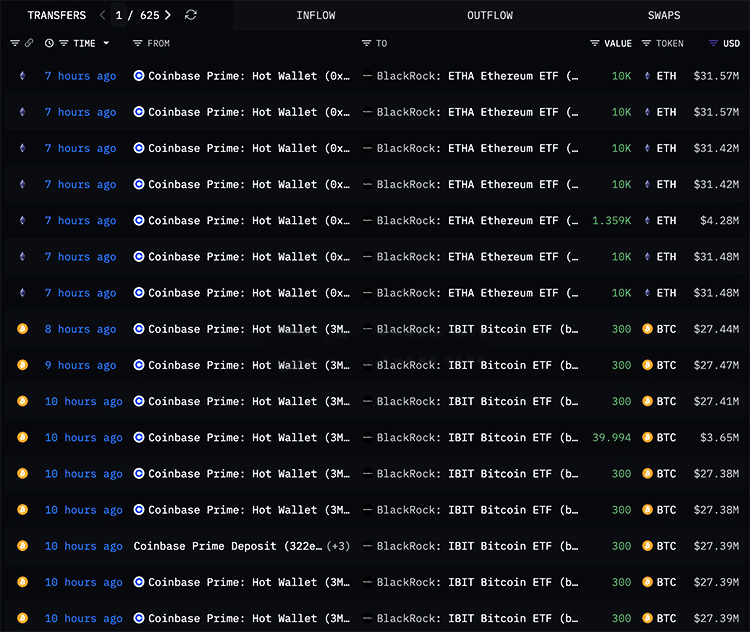

According to LookOnChain data, BlackRock has cumulatively purchased 9,619 Bitcoins (approximately $878 million) and 46,851 Ethereum (approximately $149 million) in three days, totaling approximately $1.027 billion in increased holdings.

This aggressive buying behavior amidst increased market volatility demonstrates institutional investors' confidence in cryptocurrencies. The first week of 2026 saw a significant injection of liquidity into the market, with BlackRock being a major driver. On-chain data shows that on January 6th, the company purchased 3,948 Bitcoins, worth approximately $371.89 million, and accumulated 31,737 Ethereum, worth approximately $100.23 million.

Bullish Indicator for Traders?

From a trading perspective, the large-scale inflow of institutional funds is noteworthy. Such concentrated buying often occurs during periods when institutions anticipate price increases for Bitcoin and Ethereum. Traders should closely monitor key support and resistance levels for Bitcoin, which has shown resilience near $90,000 during similar accumulation phases.

Furthermore, the ETH purchases coincide with its ongoing network upgrades, suggesting a potential price breakout above $3200, which could trigger a surge in trading volume.

Bitcoin and Ethereum have fallen by 2.18% and nearly 4% respectively in the past 24 hours. As of press time, Bitcoin is trading at $907,300 and Ethereum at $3142, according to CoinMarketCap data.

BlackRock and Strategy – Will There Be More Bitcoin Purchases?

During the holiday season, BlackRock quietly transferred Bitcoin and Ethereum to Coinbase Prime, sparking fears of a sell-off. The asset management company deposited 1134 Bitcoins and 7255 Ethereum to Coinbase. At that time, Saylor's Strategy, the largest corporate holder of Bitcoin, purchased 1,287 Bitcoins, bringing its total holdings to 673,783 Bitcoins.

BlackRock's recent increase in holdings indicates that powerful investors are accumulating Bitcoin, setting a bullish tone for 2026.

For more news and information, please click to join our official Telegram channel.