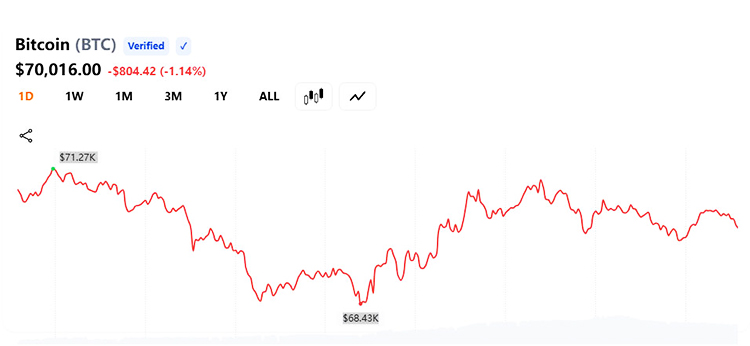

On the afternoon of February 9th, Bitcoin rebounded strongly after falling to $68,285, once again approaching $71,000. This recovery was mainly driven by news of institutional buying—Strategy announced the purchase of 1,142 Bitcoins for $90 million, and Binance also increased its holdings of Bitcoins by 4,225 for its Security Asset Fund (SAFU).

Strategy and Binance Increase Reserves

Bitcoin (BTC) rebounded quickly after an early morning drop on February 9, supported by institutional buying despite heavy selling pressure from miners. The price fell to a low of $68,285 around 10:00 AM ET before recovering to around $71,000.

Strategy acquired another 1,142 Bitcoins, worth approximately $90 million, through its market equity program, bringing its total Bitcoin holdings to 714,644. Notably, this increase comes after the company reported a $174 billion operating loss in its Q4 2025 earnings report, primarily due to unrealized book losses on digital assets resulting from the previous price correction.

Binance also supported the market, adding 4,225 BTC to its SAFU fund. This purchase is part of its $1 billion buyback program, aimed at shifting emergency reserves to more transparent, on-chain traceable assets such as Bitcoin.

Institutional Inflows Offset Miner Selling Pressure

Institutional inflows effectively offset selling pressure in the mining sector. Cango sold 4,451 bitcoins over the weekend, raising $305 million to reduce leverage and repay bitcoin mortgages. Other mining companies such as Riot Platforms and Cleanspark also gradually reduced their bitcoin reserves.

By midday, the market capitalization of bitcoin had returned to over $1.4 trillion, and the total cryptocurrency market capitalization stabilized at nearly $2.5 trillion. Despite the seesaw-like price fluctuations, the liquidation was relatively limited—only $400 million in positions were liquidated in the past 24 hours, indicating that recent volatility has significantly squeezed out excessive speculation in the market.

Bitget Chief Marketing Officer Ignacio Aguirre Franco pointed out that despite the recent market volatility, the deleveraging process is a positive sign in the long run. He believes that last week's cryptocurrency decline was mainly due to large outflows from exchange-traded funds (ETFs) and overall market deleveraging.

"These dynamics help to clear out excessive speculation, laying a healthier foundation for sustainable future growth rather than indicating structural failure," Franco said.

Looking ahead, Franco remains optimistic about Bitcoin's future performance. He predicts that if market conditions improve, Bitcoin could reach a new all-time high of $150,000 to $180,000 later this year, driven by a new wave of capital inflows and deeper liquidity from stablecoins.

For more news and information, please click to join our official Telegram channel.

Dear Customers,

Hello everyone, as China is about to usher in the Spring Festival, international logistics will be suspended. Zeus Mining is scheduled to stop shipping on February 11, 2026, and start the Spring Festival holiday from February 12 to February 23, 2026 (GMT+8). Pre-sales and after-sales service will reply to the information on February 24, 2026, and shipping will resume on February 24, 2026. Thank you for your support and trust in 2025. In 2026 and the future, we will bring better products and services to our friends.

Best wishes,

ZEUS MINING CO., LTD.