Despite the recent correction in the cryptocurrency market, exchange-traded funds (ETFs) linked to XRP continue to receive capital inflows. This provides a bullish signal for the price of XRP, as the continued influx of funds suggests that Wall Street is quietly accumulating the asset.

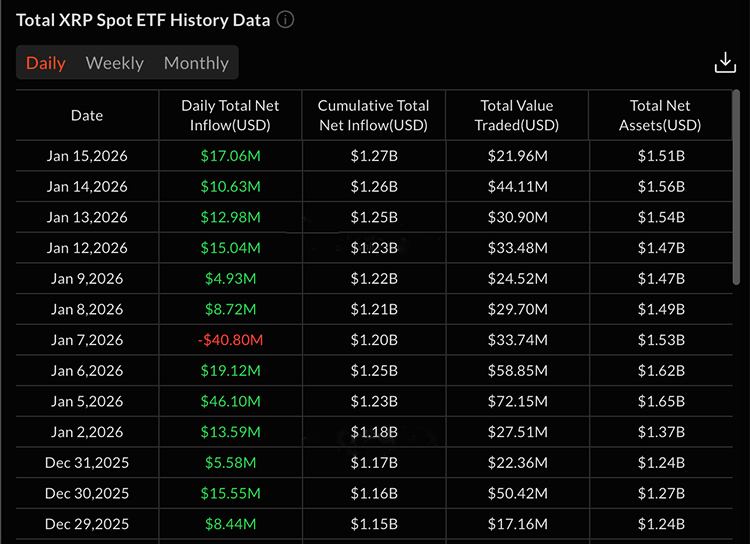

According to SoSoValue data, since the launch of the first US-based XRP ETF, there has been only one trading day with a net negative capital inflow.

As a result, the total assets held by these funds have skyrocketed to $1.51 billion in just two months, surpassing Solana’s ETF assets by more than $300 million.

In the past 7 days, XRP has booked a 2% drop, although its year-to-date gains currently sit at 12% due to a spike in the price during the first few days of the year.

This streak of positive net inflows indicates that both institutional and retail investors are steadily increasing their holdings, creating a strong floor for the token in case this pullback accelerates.

XRP Price Prediction: Move to $3 Likely If XRP Breaks Out of Descending Triangle Again

Looking at the 4-hour chart, XRP is once again showing a descending triangle pattern. Previously, when this pattern appeared, the token eventually broke out and experienced a strong rally in the short term.

Currently, the bearish structure has been invalidated in the higher time frames, so another breakout could lead to an even more significant surge, potentially pushing XRP back to at least the $3 level.

The price has recently broken above the 200-period moving average on a shorter time frame, forming a positive signal. If the Relative Strength Index (RSI) can hold above the midline and break above the 14-day moving average, it will confirm a buy signal for this altcoin.

For more news and information, please click to join our official Telegram channel.