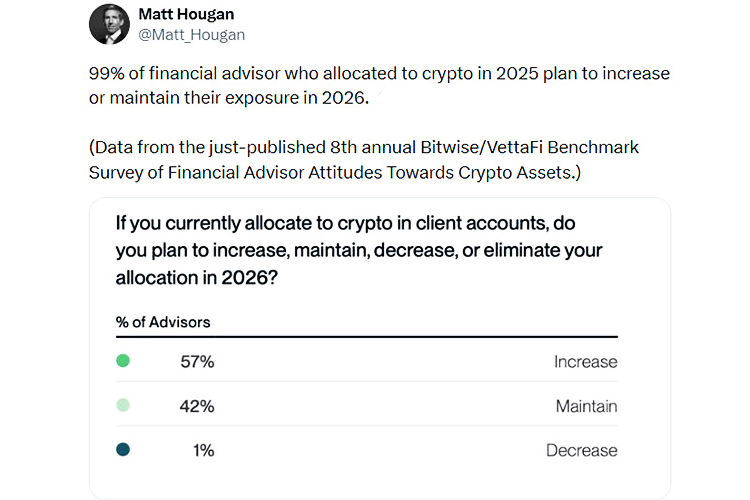

According to the latest survey released by Bitwise Asset Management, the vast majority of financial advisors who have already allocated cryptocurrencies in their portfolios plan to maintain or further increase this proportion in 2026, reaching as high as 99%. Of these, 65% of the surveyed advisors predict that the price of Bitcoin will break through the $110,000 mark by the end of 2026, driven by growing institutional demand.

Bitwise Asset Management, with over $15 billion in client assets, released its "2026 Benchmark Survey Report," revealing a significant trend: among financial advisors who invested in cryptocurrencies for their clients in 2025, almost all (99%) intend to maintain or increase their allocation in the coming year. Analysts point out that if this intention translates into actual investment behavior, the price of Bitcoin is expected to reach a high of $120,000 by the fourth quarter of 2026.

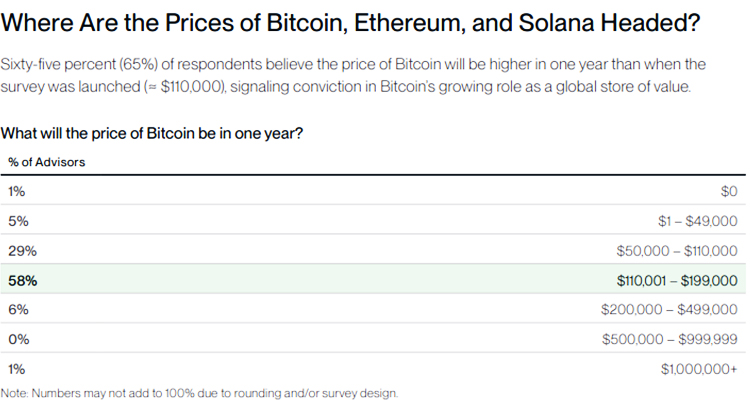

65% of advisors believe Bitcoin will reach $110,000 within a year

This survey, conducted in conjunction with VettaFi, shows that institutional demand and Bitcoin's all-time highs have led advisors to allocate cryptocurrencies at the highest rate in the survey's history.

In 2025, approximately 32% of financial advisors invested in cryptocurrencies for client accounts, up from 22% in 2024. Bitwise Chief Information Officer Matt Hougan stated: “The future of cryptocurrencies has always depended on the views of financial advisors. They are trusted advisors to millions of families and manage trillions of dollars in assets. In 2025, advisors' acceptance of cryptocurrencies reached unprecedented levels.”

Hougan added: “One statistic shocked me: 99% of advisors who hold cryptocurrencies plan to increase or maintain their holdings in 2025. People wondered how advisors would react if cryptocurrency prices fluctuated. Now we have the answer: they are planning to buy more.”

The survey collected feedback from 299 financial advisors across the United States regarding crypto assets in client portfolios, including independent advisors, broker-dealer representatives, financial planners, and representatives from large brokerage firms.

65% believe the price of Bitcoin will exceed $110,000 within a year (from its issuance price), and 58% predict the price will reach between $110,000 and $199,000 by the end of 2026.

Cryptocurrency analyst Rektcapital observed that the $93,500 resistance level is weakening, and the rebound is becoming smaller. If the weekly closing price is above this level, it may trigger a breakout into six figures.

Market Trend: Weekly chart stabilizes around $90,000

Observing the Bitcoin weekly chart, the market has calmed down after a deep correction, and the price is trying to return to key structural levels. Currently, Bitcoin is trading in the $90,000 region, and its 9-week moving average, after acting as dynamic resistance, has gradually flattened, and the market has entered a consolidation phase.

The overall upward trend from 2023 remains unchanged, with the price continuing to stay above the main weekly demand zone between $67,000 and $70,000, which defines the bottom of the macro bull market.

The most important recent area is the $100,000 to $103,000 range, which was previously an area of price distribution and retracement. If Bitcoin's weekly closing price is above this range, it indicates that sellers have absorbed the selling pressure, and Bitcoin is ready to resume its trend.

After breaking through this level, the previous range high between $116,000 and $120,000 will once again become the focus, serving as the next upward target.

Market momentum remains weak but constructive. The Relative Strength Index (RSI) is holding around 40, indicating that the market is in a consolid, Bitcoin often forms a bottom in this RSI range before an upward move.

In the short term, Bitcoin's price may fluctuate between $80,000 and $100,000, while market momentum gradually recovers.

A decisive break above $100,000 would confirm the trend resumption and open the way to $116,ation phase rather than a weak phase.

Historically000 to $120,000.

Failure to reclaim this level may prolong the consolidation, but further downside seems limited unless the price breaks below the weekly support level of $67,000 to $70,000.

For more news and information, please click to join our official Telegram channel.