Bitcoin is often called "digital gold," and some supporters even believe it is superior to gold, but market performance doesn't reflect this. Gold's bull market shows no signs of slowing down: it rose by 25% in the past month, 66% in the past six months, and a staggering 200% in the past five years.

This performance far surpasses Bitcoin. Bitcoin fell by 2.5% in the past month, and its decline reached 25% in the past six months. Since 2021, its return has been 156%, significantly lower than gold.

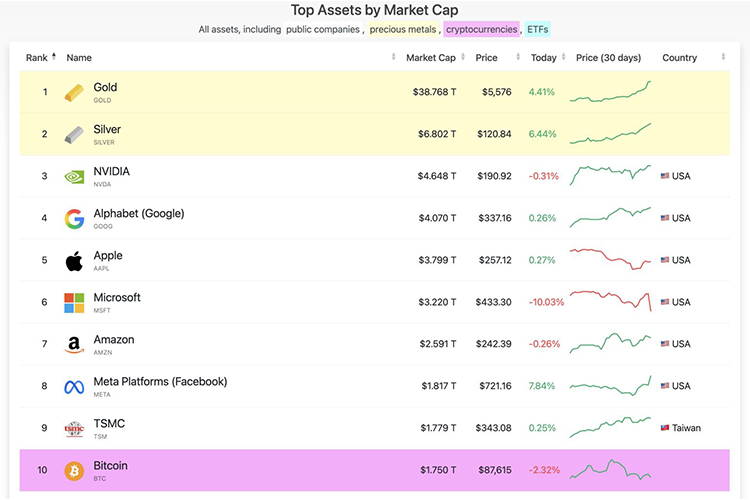

Not only gold, but other commodities are also rising. The influx of safe-haven funds has pushed silver to a new high of $120 per ounce. The market landscape has changed dramatically: in April 2025, Bitcoin's market capitalization was higher than silver's, but now silver's market capitalization has soared to $6.7 trillion, while Bitcoin's is only about $1.75 trillion.

Copper prices have also followed suit. 2025 was the best year for copper prices in a decade, driven by global mining shortages and renewable energy demand, with prices exceeding $14,000 per ton.

Bitcoin holders may be envious of the frenzied demand for precious metals—something that hasn't been seen in the crypto market for a long time. One data point illustrates how strong this rally is: on Wednesday alone, gold's market capitalization increased by $1.6 trillion, almost equivalent to the entire market capitalization of Bitcoin.

Why is this happening? Analysts point out that this actually shows that Bitcoin is maturing as an asset, especially after the launch of related ETFs two years ago. The influx of Wall Street funds has reduced Bitcoin's previous high volatility; while the exciting dramatic price swings are gone, the risk of sharp declines has also decreased.

Some also mentioned that the flash crash on October 10 last year, triggered by rumors of Trump's tariffs, made market sentiment very cautious. That sell-off even caused Binance's system to be overwhelmed for a time. The popularity of gold also has its underlying reasons. Trump's continuous criticism of Federal Reserve Chairman Powell has raised concerns about the Fed's independence during his second term, thus driving capital flows into gold.

While Bitcoin is gaining increasing acceptance among institutional investors, with significant inflows into related ETFs, gold still enjoys broader recognition, as some institutions have pointed out.

Considering Bitcoin's past cyclical patterns—a 74% drop in 2018 and a 64% drop in 2022—it's understandable that investors are currently cautious about buying large amounts of Bitcoin. Despite changes in market conditions, a significant correction is still possible in 2026.

However, just as Bitcoin often falls after a surge, some are beginning to worry that gold and silver may experience an "ugly and sustained reversal," as precious metals trading currently appears quite crowded.

In the short term, Bitcoin may still experience a difficult period. Reports indicate that some long-term Bitcoin bulls are now turning to stocks, precious metals, and prediction markets for returns, meaning Bitcoin is temporarily no longer the market leader.

Some analysts believe that Bitcoin needs to consistently trade above $100,000 to truly prove its value. However, with even $90,000 proving difficult to break through, this target seems quite challenging.

For more news and information, please click to join our official Telegram channel.