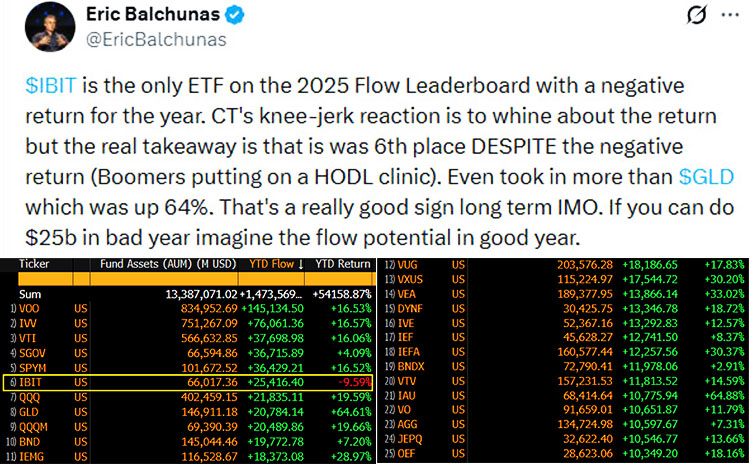

BlackRock’s spot Bitcoin exchange-traded fund IBIT, has emerged as a notable outlier on the 2025 ETF flow leaderboard, ranking sixth by year-to-date inflows despite posting a negative return for the year, according to data highlighted by Bloomberg Intelligence analyst Eric Balchunas.

IBIT is currently the only ETF among the top flow leaders showing a year-to-date loss, with returns down roughly 9.6%. Yet the fund has still attracted approximately $25.4 billion in net inflows, placing it ahead of a range of established equity and commodity products — including the SPDR Gold Trust (GLD), which is up more than 64% over the same period.

Investor Demand Signals Shift Toward Long-Term Allocation

The divergence between price performance and investor demand underscores a structural shift in how capital is engaging with Bitcoin exposure through regulated vehicles. Rather than reacting to short-term price movements, investors appear to be using periods of drawdown to accumulate positions via ETFs.

\Balchunas describes the trend as a “HODL clinic,” suggesting that longer-term allocators are increasingly driving flows into spot Bitcoin ETFs, treating them as strategic holdings rather than momentum trades.

Equity ETFs Still Dominate, but Bitcoin Stands Out

By comparison, the largest inflows in 2025 have gone to broad-based equity ETFs such as Vanguard’s S&P 500 tracker VOO, which has drawn more than $145 billion in net inflows alongside a mid-teens return. Other top-ranking funds include large-cap and total market products such as IVV, VTI, and SPYM, all benefiting from strong equity market performance.

IBIT’s presence among these vehicles is notable given Bitcoin’s higher volatility and its relatively recent introduction as an ETF asset class.

Bitcoin ETFs Outpace Gold Despite Underperformance

The data also highlights a contrast with gold ETFs. While GLD has benefited from strong price appreciation in 2025, its inflows have lagged behind IBIT’s, indicating that performance alone has not been the primary driver of allocation decisions this year.

According to Balchunas, the more significant takeaway may be what IBIT’s inflows imply for future cycles. If a Bitcoin ETF can attract more than $25 billion in a year marked by negative returns, the potential for substantially larger inflows during a strong market environment could be considerable.

As spot Bitcoin ETFs continue to mature within traditional portfolio frameworks, flow data is increasingly being viewed as a leading indicator of long-term adoption. IBIT’s 2025 performance suggests that, even amid price weakness, investor conviction in regulated Bitcoin exposure remains resilient.

For more news and information, please click to join our official Telegram channel.

Dear Customers,

Hello everyone, as China is about to usher in the Spring Festival, international logistics will be suspended. Zeus Mining is scheduled to stop shipping on February 11, 2026, and start the Spring Festival holiday from February 12 to February 23, 2026 (GMT+8). Pre-sales and after-sales service will reply to the information on February 24, 2026, and shipping will resume on February 24, 2026. Thank you for your support and trust in 2025. In 2026 and the future, we will bring better products and services to our friends.

Best wishes,

ZEUS MINING CO., LTD.